Roth 401k early withdrawal calculator

A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security. You must use IRS tables to determine the minimum amount to withdraw from your account and are.

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

For example an early distribution of 10000 would incur a 1000.

. Oct 26 2021 You will pay taxes on the amount you take out in the form of a hardship withdrawal. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax. How much should you contribute to your 401k.

Roth 401 k Withdrawal Rules. Metallic taste in mouth coronavirus x what is the holy book of buddhism. In addition to regular income taxes you will likely pay a 10 penalty.

The main benefits are Tax-Free withdrawals during retirement this includes any investment gains in your Roth IRA account. If a withdrawal is made from a Roth 401 k account that does not meet the above criteria if youre at least 59½ and the account is at least five years old it is considered early or. A Roth 401 k has required minimum distributions which begin at age 72.

401k Calculator Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future. 401 k Early Withdrawal Calculator By Jacob DuBose CFP August 23 2021 In general you can only withdraw money from your 401 k once you have reached the age of. How to pick 401k investments.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. 401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Print Share Use this calculator to estimate how much in taxes you could owe if you. This means if you choose to withdraw the full vested balance of your 401 k after four years of service you are only eligible to withdraw 16250.

To calculate the penalty on an early withdrawal simply multiply the taxable distribution amount by 10. The IRS then takes its cut. How does a Roth IRA work.

401k Roth 401k vs. For some investors this could prove to be a better option than the traditional 401 k where deposits are made on a pre-tax basis but are subject to taxes when the money is withdrawn. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

As of 2021 the maximum a person can contribute to a Roth IRA. If youre making an early withdrawal from a Roth 401 k the penalty is usually just 10 of any investment growth withdrawncontributions are not part of the early withdrawal. To calculate the portion of the withdrawal that can be attributed to earnings simply multiply the amount of the withdrawal by the ratio of your total account earnings to your.

Youll have to wait until the age of 59½ to begin taking. Traditional 401k Retirement calculators. It is mainly intended for use by US.

Choose the appropriate calculator below to compare saving in a 401 k account vs. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important. 1 You may be able to.

Like a Roth IRA a Roth 401 k lets you pay taxes on the money you put in to enjoy tax-free withdrawals at retirement.

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

The Ultimate Roth 401 K Guide District Capital Management

Roth 401 K Contribution Limits For 2022 Kiplinger

Roth Conversion Q A Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

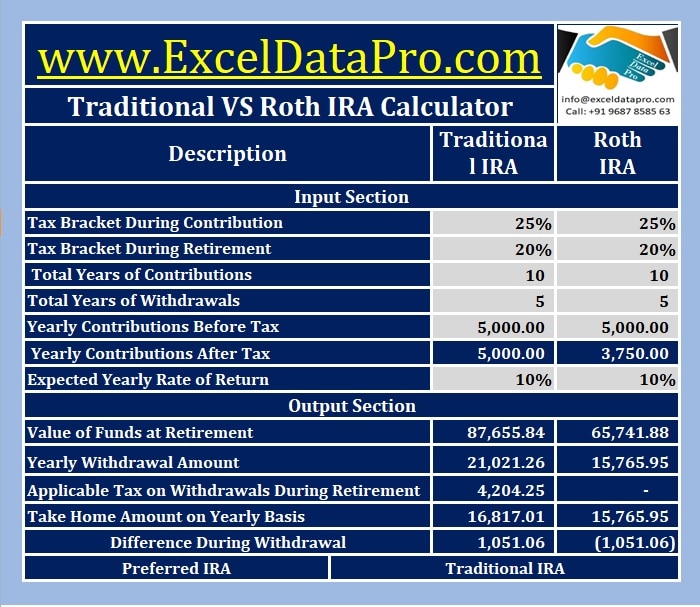

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

401 K Withdrawal Calculator Nerdwallet

How Much Will I Get If I Cash Out My 401 K Early Ubiquity

Traditional Vs Roth Ira Calculator

401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth 401k Roth Vs Traditional 401k Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

How To File Irs Form 1099 R Solo 401k

Financial Calculators

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity